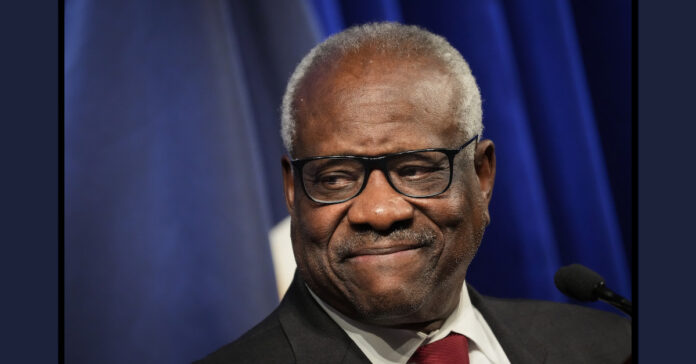

Associate Supreme Court Justice Clarence Thomas speaks at the Heritage Foundation on October 21, 2021 in Washington, D.C. (Photo by Drew Angerer/Getty Images.)

U.S. Supreme Court Justice Clarence Thomas is facing new allegations of ethics violations after an official report showed that he never reported that a wealthy friend loaned him $267,000 for the purchase of a luxury RV, then forgave the loan — perhaps in its entirety.

In the latest chapter of what some have called the Court’s “self-inflicted ethics crisis,” the Senate Judiciary Committee posted on X, previously known as Twitter, on Thursday that a “[n]ew report finds that Justice Clarence Thomas failed to disclose $250,000+ of loan forgiveness for an RV, lent to him by a wealthy health care industry benefactor.”

After an investigation, the committee found that health care mogul Anthony Welters loaned Thomas funds for the deal, and that Thomas appears neither to have repaid the loan principal nor to have reported the corresponding loan forgiveness. Thomas has already come under fire for undisclosed luxury trips aboard the “superyacht” of billionaire GOP supporter Harlan Crow.

From superyachts to Walmart parking lots

Questions about Thomas’ land-based vacations emerged after a New York Times story ran in August 2022 about the justice’s purchase of a Prevost Le Mirage LX Marathon motor coach in 1999. Thomas was quoted discussing how the RV he “scrimped and saved to afford” allowed him to escape the “meanness that you see in Washington” and spend time with family touring what some consider the “flyover states.” Thomas still owns the RV today and has often commented that he loves using it to spend time with ordinary people in Walmart parking lots.

“There’s something normal to me about it,” the justice said about the vehicle in a 2020 documentary.

Senate Finance Committee Chair Ron Wyden, D-Ore., however, had a far less folksy take on Thomas’ road trips. In a statement Wednesday, Wyden said, “Regular Americans don’t get wealthy friends to forgive huge amounts of debt so they can buy a second home,” and demanded that Thomas inform the committee about the precise details of the loan forgiveness and his reporting history.

A Senate Finance Committee report Wednesday titled “Clarence Thomas did not repay entire principal on $267,230 loan from Tony Welters” filled in some of the missing information. The committee said it reviewed documents that suggested that Thomas did not repay “a significant portion of the loan principal,” and that no documents showed that the justice ever made any payments of the loan principal.

Loan terms between friends

The report said that as part of the current inquiry, Welters “voluntarily provided” loan information that included a handwritten note from Thomas to Welters on Supreme Court stationery dated Dec. 6, 1999 referencing a promissory note and a security agreement. The promissory note showed Clarence and Virginia Lamp Thomas as “Makers” and Welters as “Payee” on a debt of $267,230.00, to be repaid at a 7.5% annual interest rate, payments due annually. The loan was to mature on Dec. 31, 2004, at which time all principal and interest payments would be due. Per the terms of the security agreement, Welters kept a security interest in the RV.

The report said it reviewed records of one payment by Thomas made in the first year following the loan’s initiation for one installment of the annual interest payment of $20,042.23.

On the 2004 maturity date, however, the Thomases and Welter signed another agreement in which they extended the maturity date an additional decade to 2014. The committee reviewed a 2008 note from Welters to Thomas that stated the justice “has been paying Welters interest only on Thomas’s bus for many years,” and that because the interest payments exceeded the purchase price of the bus, “Welters did not feel it was appropriate to continue to accept payments even though he had the right to them.”

The ethics of forgiveness

The committee’s conclusion was that “Anthony Welters forgave a substantial amount, or even all of the principal balance of his loan to Clarence Thomas, constituting of the forgiveness of approximately $267,230.00 of debt owed by Justice Thomas.”

The United States tax code is clear that discharge of debt counts as income for tax purposes. Federal statute 26 U.S.C. §61 provides the definition that “gross income means all income from whatever source derived” and sets out 14 categories that specifically constitute income. Alongside categories such as rent, dividends, commissions, compensation, and fringe benefits is “income from discharge of indebtedness.”

Per IRS regulations, “If you borrow money and are legally obligated to repay a fixed or determinable amount at a future date, you have a debt….If your debt is forgiven or discharged for less than the full amount owed, the debt is considered canceled for the forgiven or discharged amount that you no longer need to pay.”

Those regulations clarify that debts are considered “forgiven” even “if the creditor can’t collect, or gives up on collecting” and that foreclosure or repossession on property could constitute debt cancelation in the case of a secured loan.

IRS reporting obligations are relatively clear.

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. If taxable, you must report the canceled debt on your tax return for the year in which the cancellation occurred.

According to the committee’s report, Thomas failed to report the forgiven debt on his 2008 Financial Disclosure Report, and that since the loan came to light in August 2023, Thomas provided no information about it or about any forgiven debt.

Former Bush White House ethics attorney and law professor Richard Painter posted in response to the findings:

A free $267,000 RV from a friend in the health care industry? How many health care cases did he decide? As I point out in an article forthcoming in the Georgetown Journal of Legal Ethics, this Court needs a full time ethics lawyer and an inspector general.

Painter’s call for additional Supreme Court ethics checks echo recent comments made by Justice Amy Coney Barrett who said adopting a Court ethics code as “a good idea.”

Have a tip we should know? [email protected]