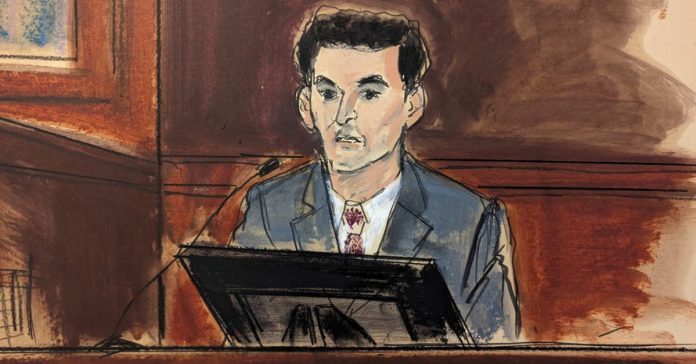

In this courtroom sketch, FTX founder Sam Bankman-Fried is questioned during his trial in Manhattan federal court, Thursday, Oct. 26, 2023, in New York. (Elizabeth Williams via AP)

Sam Bankman-Fried, the onetime crypto billionaire, was convicted on Thursday of cheating customers and investors of at least $10 billion.

Bankman-Fried was convicted by a Manhattan jury, who rejected his denial from the witness stand, The Associated Press reported.

“His crimes caught up to him. His crimes have been exposed,” Assistant U.S. Attorney Danielle Sassoon told the jury, the wire service reported.

His attorney, Mark Cohen, said in closing arguments that prosecutors were trying to turn him into “some sort of villain, some sort of monster,” the AP reported.

“It’s both wrong and unfair, and I hope and believe that you have seen that it’s simply not true,” he said. “According to the government, everything Sam ever touched and said was fraudulent.”

Bankman-Fried was indicted in December on eight counts, including wire fraud, conspiracy and campaign finance violations.

The Department of Justice and the Securities and Exchange Commission claim that the 31-year-old cryptocurrency mogul raised more than $1.8 billion from investors in his since-failed FTX cryptocurrency exchange while allegedly diverting his customers’ money to Alameda Research LLC, his privately-held hedge fund. He pleaded not guilty in January. According to a superseding indictment issued in March, Bankman-Fried allegedly directed payments to Chinese officials of at least $40 million in cryptocurrency bribes for them to unfreeze his accounts.

Bankman-Fried purportedly became a billionaire as the exchange was marketed to a mass audience: FTX famously advertised during the Super Bowl with a guest appearance by Curb Your Enthusiasm’s Larry David, who has been sued for his appearance in the ad.

Bankman-Fried also aggressively courted Capitol Hill, often with strategic political donations and expressing openness to federal authorities regulating his industry.

He had also testified before the House Financial Services Committee and the U.S. Senate Committee on Agriculture, Nutrition and Forestry. He was slated to appear at a congressional hearing about the November 2022 collapse of FTX that had been scheduled just days after his arrest.

Marisa Sarnoff and Adam Klasfeld contributed to this report.

Have a tip we should know? [email protected]